Business Finance

Business Credit, Business Capital, Business Loans, Business Strategies, SBA Loans, Business Insurance, Liability Insurance, Tax, Business Valuation

Business Credit

New businesses are seldom profitable at first, and even a successful business can have dry periods where profits are not enough to cover necessary financial obligations. Many businesses use a business credit card for their expense accounts. This is why it so important to have the business credit necessary to utilize financing options when the need arises.

A business credit line can give a business the flexibility and adaptability it needs to remain viable. This is an excellent financial asset for any small business to have. The funds from a business line can be used for a variety of purchases, including growth, renovations, payroll, inventory or marketing. A business credit line gives your company the flexibility and stability it needs to be successful.

A business credit line offers a lump sum of pre approved money. This is essentially the same as applying for a large loan, even if you don’t have a need for the funds. But that’s the great part. You can utilize as much of the credit line as you need, leaving the rest in the account. Should the need for extra money occur, you already have the pre approved balance that you can withdraw from virtually instantaneously.

With your business line of credit, you always have a pre approved balance waiting for you. This means you wont have to go through another loan process, or face the possibility of being denied should your credit change.

Business Capital

Do you need to start or grow your business but have little money? Here are some ways of financing your own business by using your own initiative and depending less on outside bank financing.

1. Operate a Home-Based Business. Operating your business from home could save you a fortune. First of all, you eliminate the costs of expensive commercial rent, commuting, et cetera. As well, your business use of home expenses would be deductible for income tax purposes. Since your home is your base of operations, your travel and automotive expenses from your home to clients would be deductible.

2. Accept Credit Cards Rather than financing receivables and assuming the risk for bad debts, why not accept credit card payments?

3. Use Your Customer’s Money Selling memberships, subscriptions, gift certificates, and coupon books are just a few ways of getting your clients to pay upfront. Obtaining advance deposits and retainers from your customers can help finance your business operations and reduce or eliminate the need for bank financing.

4. Let us help you with other possibilities.

Business Loans

Obtaining finance is central for starting a new business or making business grow. Financing a business through business loans can be a formidable task. But a good preparation can easily sort out any matter detrimental to getting your business loans approved. Taking a loan for business is an important decision.

A business loans borrower must understand that while taking loans can help a business grow, a wrong decision will mean debt and actually damage financial stability of a business. Determine how much loan amount you require as business loans. There are different business loans products to decide from. A well thought out business plan is the most significant part of getting a business loans approved.

Few people realize it but locating a good business loans lender is integral to finding business loans. It is not easy to find business loans lender that abides by your needs. In fact it is an investment in itself. Look for business loans lender who is willing to work with you and for you.

Business Strategies

1. No matter how small you are you can change lots of lives – your goal for starting your business should be to change lives in one way or another. Remember this in everything you do – how can I change my customers lives?

2. Climb that wall – no matter how big the wall is – persistence pays off in the end. Never give up on your dreams and keep on trying.

3. Times when you appear small and frail are when you can surprise everyone with your hidden strengths. Everyone in business pays attention to what the big boys are doing and how they became successful. What they miss though is the small businesses that quietly make substantial profits every year. These companies go about their business quietly and draw attention from the customers – not the competition.

4. Act like a silly goof whenever and wherever you want – people will never forget you – and that is what every business owner should dream of – sticking in everyone’s mind.

5. Remember to share – People can get very protective of what they learn and how they achieve success. When you have something of value that would benefit others – share! IT will come back to you one hundred fold. You do have you rights also – protect what is not to be shared and make sure others know it is yours and yours only.

SBA Loans

Just as every small business is unique, there are almost as many distinctive options available when it comes to securing small business loans or other funding options for your small business startup expenses or other ventures.

Further, amid the various programs offered by the variety of lenders, the programs availability, terms, etc. may different from state to state even in the small business loan provider remains the same.

While the U.S. government’s SBA (Small Business Administration) does not offer grants for starting or expanding small businesses, they do still offer a plethora of free help. The SBA has existed since 1953, and in that time it has assisted tens of thousands of Americans form small businesses through their outreach programs, now available in every U.S. state, the territories of Puerto Rico and the Virgin Islands, and the District of Columbia (Washington D.C.).

SBA offices are a rich resource of information and options in obtaining small business loans. Although the SBA does not directly loan or grant money, they are an invaluable asset to starting, maintaining and growing your company or determining your small business loan resources with localized options.

Business Insurance

As a businessman you might have public liability insurance and you insure your buildings, stock and vehicles. You may even have professional indemnity insurance and legal cost insurance. Is that all? What about your other primary assets – your key staff?

Key staff represent the heart of every businesses and prolonged absence through serious illness or even death can be terminal for some enterprises. The risks are the same for limited companies, a partnerships and sole traders.

The insurance can’t replace people but it can provide cash to buy time and cover the costs of temporary staff, recruitment, loss of profits or provide a cash injection.

Do you travel? Many things can go wrong during a business trip. This can be your baggage loss or a flight cancellation, or your destination become unreachable due to bad weather, or even you can fall ill and have to postpone the trip.

You cannot control such events, but with the help of proper Business Insurance, you can minimize their outcome. Whether it is a small enterprise or a large corporation, the success of a business is largely based on the dedication and hard work of the members of that organization. But it doesn’t matter how industrious you are, because one disaster or catastrophe can destroy your business and wipe out all the profits.

So what kind of business insurance is appropriate?

Liability Insurance

Here are some valid questions to ask a broker about the insurance company offering coverage:

• Does the insurance company specialize in professional liability?

• Is it an approved surplus lines insurer in the state and rated at least A VII by Best?

• Does the insurance company oversee its own claims handling or farm that responsibility out to an independent adjustment firm or third party administrator?

• Will the claims adjuster provide you with a listing of law firms in your state from which to choose your defense counsel and will the company work with you to consider a firm you recommend?

• Is the insurance company willing to defend a spurious claim in order to protect your reputation in the community, or do they have a “get out the check book mentality” to close the claim regardless?

• Will the insurance company regularly communicate the status of the claim with you and seek your input as to settlement or defense strategies?

Tax

Don’t the complexities involved in doing your taxes bug you, specially, if you own a small business? Following and getting familiarized with the guidelines laid down by the IRS for small businesses is very important.

In case you hire other employees for your business, you should attach two forms on your, as well as your employee’s, behalf. The W-4 form gives the details of the withholding allowance and the filing status of your employee to the IRS. The other important document to be filled up is the Form I-9 that gives the proof of eligibility of every employee to work in the United States.

There are a few things that can be done to make sure that the process of filing your taxes is smooth and easy while taking into consideration that you are a small business owner:

a. There can be nothing like getting familiarized with the taxing procedures for small businesses.

b. The IRS has framed a special program known as STEP, or Small Business Tax Education that you can go through to understand the overall tax structure.

c. There are many state governments that offer special tax deduction packages to many small business owners.

d. Be careful about classifying your employees in tax forms. Sometimes the IRS mixes up the actual employees with the contractors.

e. You should be aware of the sales tax that is applicable on your kind of business.

f. In order to file your taxes, you should be prepared with all your documents and paperwork. The audit, stubs, records, licenses, permits, receipts, and all the other documents should be placed in order.

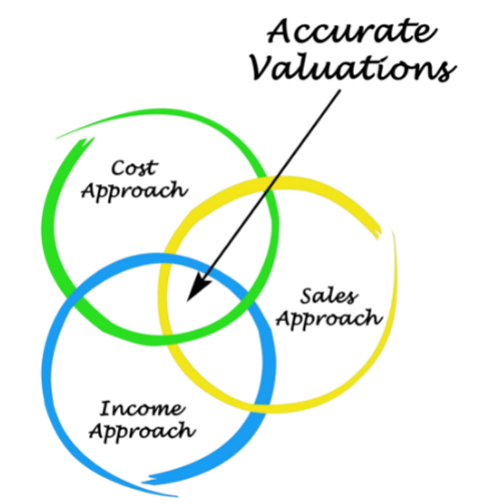

Business Valuation

Many types of business valuation methods are appropriate when estimating or defining a business value for certain kinds of business evaluations and appraisals. The reason for the evaluation determines which measure will be used.

For example, if the purpose is to borrow money, asset values will be key because lenders will be interested in collateral. If the value is based on the selling price of the business, then what the business owns, what it earns, and what makes it unique will be important.

The following is a list of many different types of business valuations that can be performed.

- Insurable value

- Book value

- Liquidation value

- Fair market / stock market value

- Replacement value

- Reproduction value

- Asset value

- Discounted future earnings value

- Capitalized earnings value

- Goodwill value

- Going concern value

- Cost savings value

- Expected return value

- Conditional value

- Market data value

Wealth Management or Wealth Planning. We’re Here to Help.

DFG has been my insurance agent for years. They have explained the ins and outs of the industry quite well. I would highly recommend DFG as your agent for life insurance, long term care insurance, tax free retirement, and other insurance plans.